Finance

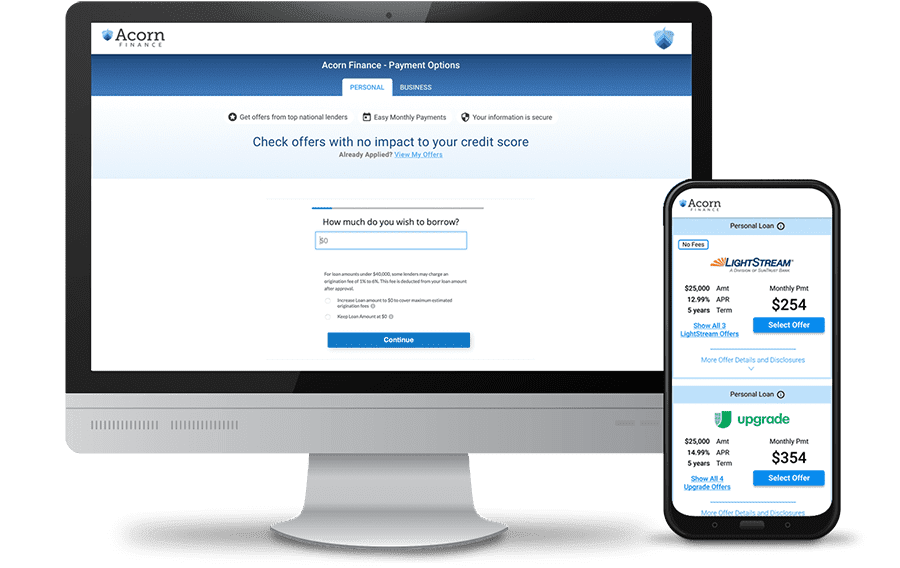

We have teamed up with Acorn Finance to offer simple financing options.

Buy Now, Pay Monthly

At Acorn Finance — an open marketplace with top national lenders — you’ll have all the help you need for financing your needs and wants.

Zero credit score impact

APRs as low as 6.24%

Loans up to $100k

Terms up to 12 years

Get funded within a week

No pre-payment fees

How Acorn Finance Works

1. Pre-qualify

Fill out easy online form to check for pre-qualified offers with no impact to your credit score.

2. Select offer

Compare terms and payment options to select the offer that’s best for you.

3. Complete application

Complete application process on your selected lender’s website.

4. Receive funding

After loan approval, your funds should arrive within the week.

Top National Lenders & Partners

Acorn Finance is ACCREDITED, SAFE, AND SECURE

They use 256-Bit SSL encryption for transmission of your information.

| Acorn Finance | Credit Unions | Credit Cards | Community Banks | |

|---|---|---|---|---|

| Instant Online Pre-Qualification | ✅ | ✖️ | ✔️ | ✖️ |

| Compare Lenders by APR | ✅ | ✖️ | ✖️ | ✖️ |

| Compare Lenders by Monthly Payment | ✅ | ✖️ | ✖️ | ✖️ |

| Check offers with no impact to credit score | ✅ | ✔️ | ✔️ | ✔️ |

Acorn Finance by the Numbers

100K

Homeowners check offers each year

$2B

In loans processed per year

12+

Top national lenders on their platform

Frequently Asked Questions

What is Acorn Finance?

They are magicians who help your home improvements dreams come true. Long answer: Acorn Finance is a lending marketplace where the nation’s premier online consumer lenders pre-qualify customers for personalised loan options in 60 seconds, with no impact to the homeowner’s credit score. Acorn Finance uses an initial soft credit inquiry to provide access to competitive, fixed-rate loans through a fast and easy online process.

How much can I borrow?

Dreams don’t come with a cap, but Acorn Finance’s network of lenders extends loans from $1,000 up to $100,000 for qualified customers. Except in California and Texas where the minimum amount is $2,000.

What can I use the loan for?

From roof to flooring, and everything in between! Funds can be used to purchase and install virtually any home improvement expense.

What are the loan terms?

Applicants with excellent credit may be rewarded with rates as low as 6.24% and extended repayment terms of up to 12 years.

How long is the loan approval process?

It’s faster than you think. Qualified applicants can be approved during business hours and may receive their funds within one business day.

What are the fees?

Acorn Finance’s network of partners charge no penalties for early repayment. For personal loans and credit lines, some partners do charge origination fees of 1-8% on loans up to $50,000. For home equity loan and home equity investment products, partners typically charge origination fees and/or other closing costs. No fee options are clearly highlighted on the Acorn offers page.

Do they allow co-borrowers?

Absolutely! Some of their funding partners accept such applications so co-borrowers are encouraged to apply. A co-borrower can be added to your Acorn form immediately after the primary applicant submits their information.

What are the fees?

Acorn Finance’s network of partners charge no penalties for early repayment. For personal loans and credit lines, some partners do charge origination fees of 1-8% on loans up to $50,000. For home equity loan and home equity investment products, partners typically charge origination fees and/or other closing costs. No fee options are clearly highlighted on the Acorn offers page.

How much does it cost to check my rates?

Zero. Zilch. Nothing. It’s absolutely free.

How does Acorn Financial make money?

Their real reward is to make your home dreams a reality. That’s why they don’t charge a penny to homeowners. Instead, they receive a small commission from the lenders.

Why can't I just go to the lenders directly?

Excellent question. The rates and terms offered on Acorn Finance are provided to them directly by the lenders. Which means they’re already making you their best offer and it won’t be different if you ask them in person. Additionally, you receive multiple offers from multiple lenders, in a few seconds, with just a few clicks, with no impact to your credit score. All under one roof! This way, you don’t just save on interest rates. You save on time, too.